NY Cannabis Market: High Costs and Tough Regulations

New York’s cannabis market has seen significant turbulence since its legalization. The financial story is compelling: retailers face tough regulations leading to high operating costs, contributing to a price disparity between legal and illicit market products.

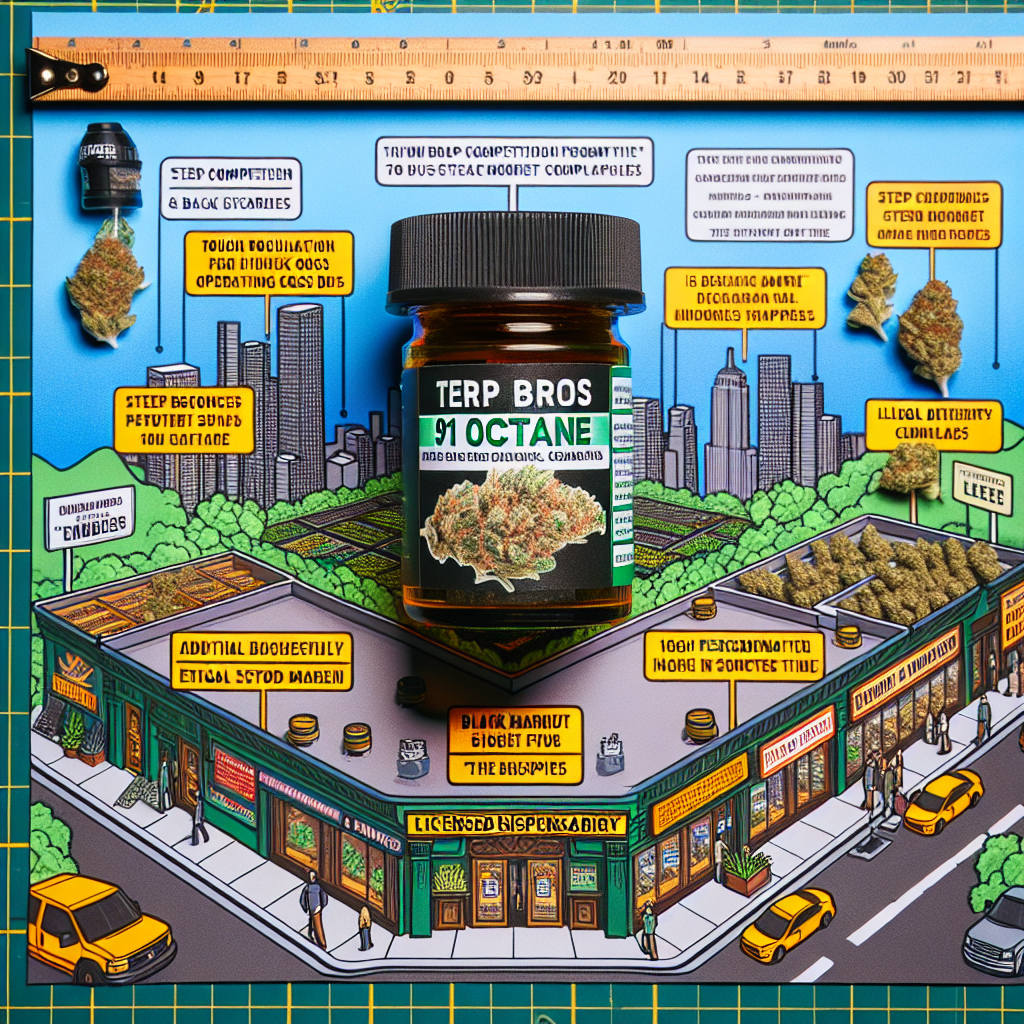

According to a detailed report in The New York Times, licensed dispensaries like Terp Bros in Queens face costs that make compliance with state laws financially burdening. These include increased security investments and higher taxes, leading to cannabis products sold at significantly higher prices compared to those from unlicensed sources.

The article outlines how a 3.5-gram jar of ’91 Octane’ strain, sold legally, costs around $60, while the same can be sourced from the black market at $40 to $50. High costs stem from stringent security requirements, high taxes – including a lack of tax deductions available to other businesses, and a heavily regulated supply chain, all of which add to the final retail price. Moreover, Terp Bros spends nearly half of its pre-cost income on federal, state, and local income taxes, which significantly surpasses what traditional businesses pay.

Adding to the complexity, retailers face steep competition from illegal dispensaries due to a slow licensing process and limited state support, as reported. This competition has driven legal businesses to cut costs and operate leanly to survive.

Despite the financial hurdles, New York has seen a rising trend in sales at licensed dispensaries, with the state even considering easing some prohibitions like discount bans to help legal businesses attract customers.

Simultaneously, industry stakeholders express concerns over proposed regulatory relaxations like reducing the 1,000-foot buffer zone between dispensaries. A report from Benzinga highlights that 94% of New York’s cannabis retailers are opposed to the easing of these zoning rules, fearing it could flood the market and destabilize the already fragile legal cannabis environment. The fears are compounded by the ongoing issues with illegal shops, which local lawmakers have also cited as detrimental to community standards.

This polarized landscape suggests that while legal cannabis has potential for economic benefit, there are significant regulatory and operational hurdles that need careful maneuvering. The ongoing debates and changes will likely shape the future dynamics of New York’s cannabis market.